SaaS Financing Strategies: Balancing Growth and Non-Dilutive Capital

Introduction to SaaS Financing Challenges

In the dynamic world of software-as-a-service (SaaS), companies often grapple with the challenge of balancing rapid growth with effective financial management. As these businesses scale, the need for strategic financing becomes crucial. Traditional methods like venture capital, while popular, come with the cost of equity dilution. This is where innovative financing strategies, particularly non dilutive funding startups, come into play.

Venture Capital vs. Non Dilutive Funding

Venture capital is a go-to for many startups. However, it requires significant time and effort from founders, often leading to a diversion of focus from business growth. In contrast, non dilutive capital presents an alternative that allows companies to grow without sacrificing equity or control. This form of financing is particularly relevant in the SaaS sector, where maintaining cash flow and managing revenue recognition are essential.

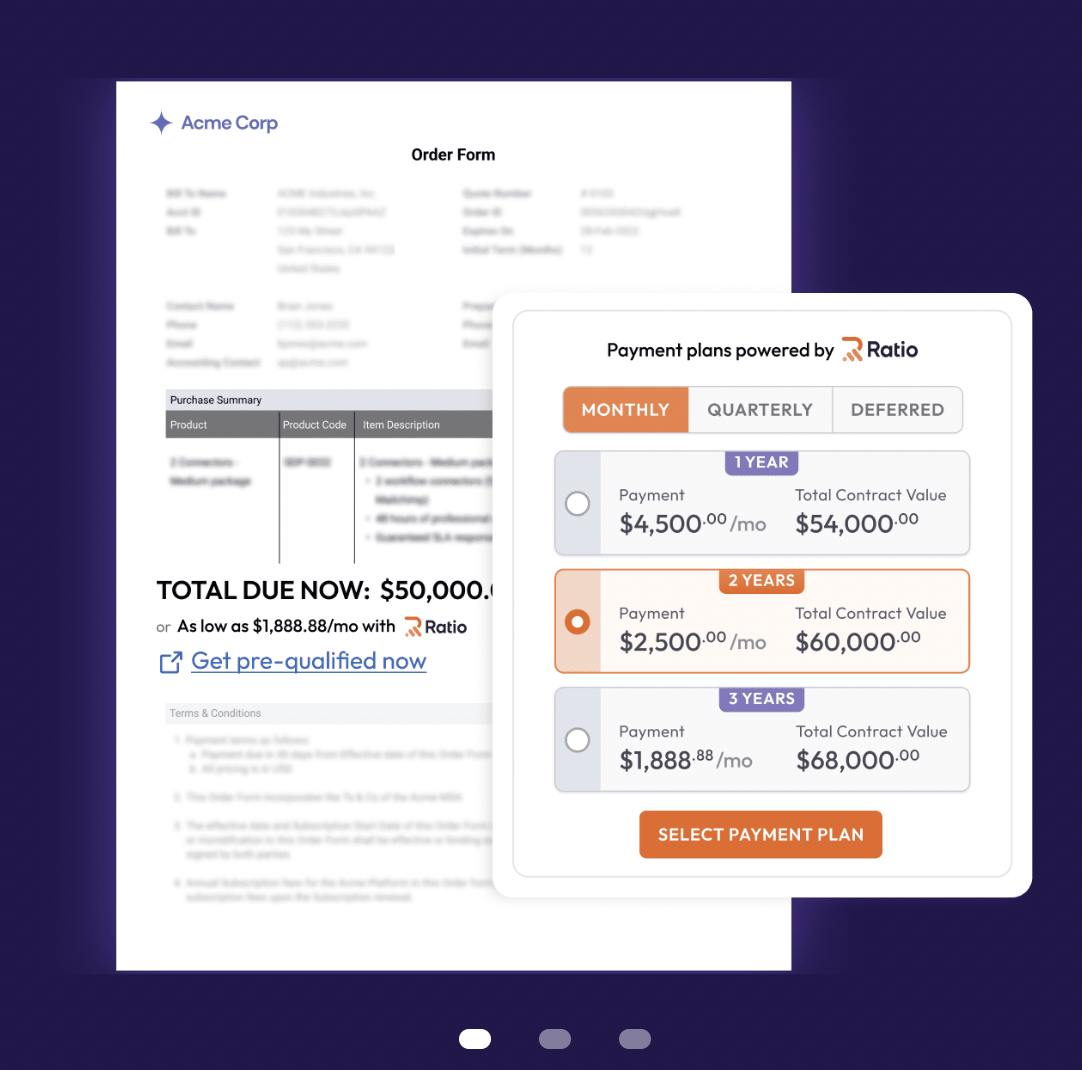

The Rise of B2B BNPL SaaS Financing

Recently, the B2B Buy Now, Pay Later (BNPL) model has gained traction in the SaaS industry. BNPL SaaS solutions offer flexible payment options for customers, aiding in improved cash flow management for the companies. These solutions are part of the broader category of true sale financing, where companies sell future revenues at a discount for immediate capital. This method aligns with the recurring revenue model central to most SaaS businesses.

Crafting a Sustainable Growth Strategy

For SaaS companies, crafting a sustainable growth strategy involves meticulous financial planning. An essential component of this is the Chart of Accounts (CoA), which provides a clear view of financial transactions and assists in cash management. Furthermore, employing tailored financial solutions like debt instruments or specific SaaS loans can balance growth while securing reserve funding.

Embracing Non-Dilutive Capital Sources

Non-dilutive capital sources, such as revenue-based financing and factoring financing, have emerged as viable alternatives for SaaS companies. These options allow businesses to leverage their recurring revenue contracts for immediate cash without dilution. It's important to note that these solutions often require personal guarantees from founders, adding a level of risk.

Utilizing Recurring Revenue for Growth

The subscription model of SaaS companies, while advantageous for steady revenue, can also lead to cash flow challenges due to the nature of accounts receivable and future service payments. Leveraging recurring revenue contracts for instant cash is a solution provided by many SaaS financing companies. This approach is complementary to traditional venture capital and beneficial during the scale-up phase.

Maintaining Financial Control

A key aspect of financing for SaaS companies is maintaining control over their financial future. Accurate financial forecasting and informed decision-making are pivotal, and a detailed CoA plays a vital role in this. While venture capital funding is a common choice for immediate funds, it often leads to a reduction in control and decision-making authority. Non-dilutive funding options, such as recurring-revenue loans, offer an alternative that aligns repayment terms with revenue growth, providing a more flexible solution for accessing capital.

Conclusion

The landscape of SaaS financing is evolving, with an increasing emphasis on non dilutive capital options like B2B BNPL and true sale financing. These strategies allow SaaS companies to maintain control over their equity while accessing the capital necessary for growth. As the industry continues to grow, adapting to these innovative financing models will be key to sustaining and scaling in the competitive tech market.

Introduction to SaaS Financing Challenges In the dynamic world of software-as-a-service (SaaS), companies often grapple with the challenge of balancing rapid growth with effective financial management. As these businesses scale, the need for strategic financing becomes crucial. Traditional methods like venture capital, while popular, come with the cost of equity dilution. This is where innovative…

Recent Posts

- Leading HVAC Services in Lexington, KY

- Puppy Love Paradise Welcomes Ohio Mini Goldendoodles to Their Beloved Family

- Ironchess SEO + Marketing Elevates Oklahoma City Businesses with Cutting-Edge SEO Solutions

- How to Find Roses for Every Occasion

- Concrete Contractor Columbus: Elevating Quality and Craftsmanship in Columbus, OH